Streamline Payroll with a Paycheck Creator: A Guide for Employers

February 19, 2025

Managing payroll can be one of the most time-consuming tasks for business owners. From calculating wages to handling deductions and ensuring compliance with tax regulations, payroll requires accuracy and efficiency. One way to simplify this process is by using a paycheck creator—a tool that automates pay stub generation and ensures employees get accurate payments on time.

In this guide, we will explore how a paycheck creator can benefit employers, what features to look for, and how it streamlines payroll management.

What is a Paycheck Creator?

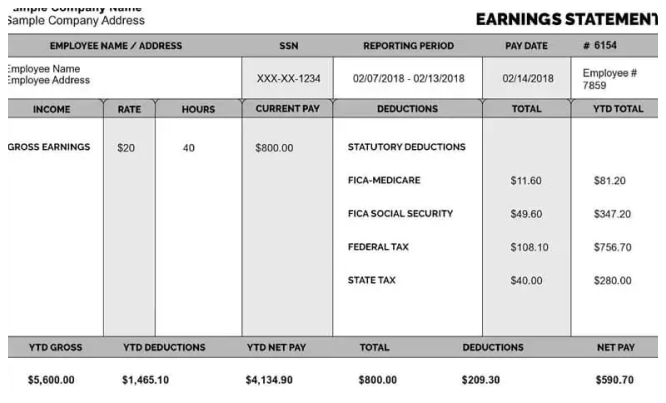

A paycheck creator is a digital tool that helps employers generate pay stubs and payroll records quickly. It automates the process of calculating employee wages, deductions, taxes, and net pay, reducing the likelihood of errors.

With a paycheck creator, businesses of all sizes can save time and ensure that payroll records are well-documented for tax filing, employee references, and compliance with labor laws.

Why Employers Need a Paycheck Creator

For businesses, maintaining an efficient payroll system is crucial. Here’s why using a paycheck creator is beneficial:

1. Saves Time and Reduces Manual Work

Manually calculating payroll takes hours, especially for businesses with multiple employees. A paycheck creator automates calculations, eliminating the need for manual data entry.

2. Ensures Accuracy

Payroll mistakes can be costly. Overpayments or underpayments can lead to employee dissatisfaction and compliance issues. A paycheck creator ensures accurate calculations, minimizing errors.

3. Improves Record-Keeping

Employers must maintain proper payroll records for tax purposes and audits. A paycheck creator stores payroll history, making it easy to retrieve past pay stubs and reports.

4. Enhances Employee Satisfaction

Employees expect timely and accurate payments. By using a paycheck creator, businesses can meet payroll deadlines without delays, keeping employees happy.

5. Compliance with Tax Regulations

Payroll taxes are complex, and incorrect calculations can lead to penalties. A paycheck creator automatically factors in tax deductions, ensuring compliance with federal and state tax laws.

Features to Look for in a Paycheck Creator

Not all paycheck creators are the same. Here are some key features to consider when choosing the right tool:

1. User-Friendly Interface

A good paycheck creator should be easy to navigate, allowing employers to generate paychecks without prior accounting knowledge.

2. Automated Tax Calculations

Look for a tool that calculates state and federal taxes, Social Security, and Medicare deductions accurately.

3. Customization Options

Different businesses have different payroll needs. A paycheck creator should allow customization, including adding company logos, specific deductions, and payment methods.

4. Secure Data Storage

Payroll data is sensitive. Ensure that the paycheck creator you choose has secure data encryption and backup features.

5. Multiple Payment Options

Some paycheck creators integrate with direct deposit services, allowing employers to send payments directly to employees’ bank accounts.

How to Use a Paycheck Creator for Payroll Management

Using a paycheck creator is simple. Here’s a step-by-step guide:

Step 1: Gather Employee Information

Before using a paycheck creator, you’ll need details like:

Employee name and address

Social Security Number (SSN)

Salary or hourly wage

Tax filing status

Benefits and deductions

Step 2: Input Payroll Details

Enter the relevant details into the paycheck creator, including:

Pay period (weekly, bi-weekly, monthly)

Overtime hours (if applicable)

Bonuses or additional earnings

Tax withholdings and deductions

Step 3: Generate Pay Stubs

Once the information is entered, the paycheck creator will calculate gross pay, deductions, and net pay. The generated pay stub can be printed, emailed, or stored for future reference.

Step 4: Distribute Payments

Employers can use the paycheck creator to generate checks or integrate with direct deposit systems for seamless payment processing.

Step 5: Maintain Payroll Records

Save digital copies of pay stubs for tax reporting and compliance. Many paycheck creators offer cloud-based storage for easy access.

Choosing the Right Paycheck Creator for Your Business

With numerous paycheck creators available, selecting the right one depends on your business size, budget, and payroll complexity. Here are some tips:

For small businesses: Look for an affordable, easy-to-use tool with basic payroll features.

For growing businesses: Choose a paycheck creator with scalability, automation, and integration with accounting software.

For large enterprises: Opt for a tool that offers advanced reporting, multi-user access, and compliance support.

Conclusion

A paycheck creator is a valuable tool for employers who want to streamline payroll processing while ensuring accuracy, compliance, and efficiency. By automating calculations, reducing manual work, and improving record-keeping, businesses can focus on growth instead of payroll headaches.

Related Articles

Access Your Pay Information Using eStub in 2025

TruBridge Paystub Not Showing? Here’s What to Do

Why Employer Should Use a Free Payroll Check Stubs Template?