Why Investment Fund Management Software Is Essential for Modern Asset Managers

June 18, 2025

In the rapidly evolving financial world, efficiency, transparency, and compliance have become critical components of successful investment fund management. Traditional spreadsheets and manual workflows are no longer sufficient to manage the growing complexities of portfolios, investor relations, and regulatory demands. This is where investment fund management software steps in—a transformative tool that streamlines operations and empowers fund managers to make better, data-driven decisions.

What Is Investment Fund Management Software?

Investment fund management software is a specialized digital solution designed to support the operational, analytical, and compliance needs of fund managers, asset management firms, and investment professionals. It facilitates the entire lifecycle of a fund—from capital raising and investor onboarding to portfolio tracking, performance analysis, risk assessment, and reporting.

These platforms are designed to reduce human error, improve data accuracy, and ensure transparency across all stakeholders. By centralizing data and automating workflows, fund management software simplifies complex tasks that once required significant manual effort.

Key Features That Drive Efficiency

Modern investment fund management solutions offer a range of robust features that improve accuracy and streamline operations:

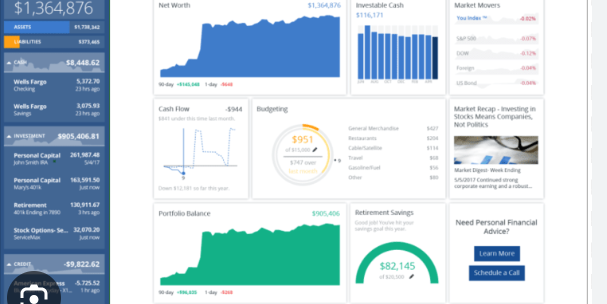

- Portfolio Management: Track and analyze real-time performance, cash flow, asset allocation, and benchmarks.

- Investor Management: Maintain detailed investor profiles, contributions, distributions, and preferences in a secure environment.

- Compliance and Regulatory Reporting: Ensure timely and accurate reporting with built-in templates aligned with global standards like FATCA, AIFMD, or SEC regulations.

- Performance Metrics and Analytics: Generate customized reports and dashboards that provide insight into ROI, risk levels, and historical trends.

- Automation and Integration: Integrate with accounting platforms, custodians, and data providers to automate reconciliations and reduce manual inputs.

Benefits for Fund Managers and Stakeholders

Implementing investment fund management software brings a host of advantages that go beyond basic operations. Here’s how businesses benefit:

- Improved Accuracy and Reduced Risk: Automated calculations and real-time data reduce the chances of costly mistakes.

- Time and Cost Efficiency: Manual data entry and reporting can consume hours of staff time. Automation significantly speeds up processes.

- Enhanced Decision-Making: Real-time insights allow fund managers to make timely and informed investment decisions.

- Scalability: Whether managing a handful of funds or a large portfolio across regions, these platforms scale effortlessly with your business.

- Investor Transparency: Clients can access self-service portals that offer detailed fund performance and personalized reports, building trust and confidence.

Use Cases Across the Financial Sector

While primarily used by asset management firms, investment fund management software is also utilized by:

- Private Equity Firms: For managing capital calls, waterfalls, and investor allocations.

- Hedge Funds: To execute high-frequency trades and manage complex derivative instruments.

- Real Estate Investment Trusts (REITs): For tracking rental income, expenses, and property portfolios.

- Family Offices: To oversee multi-generational wealth management and diversified investments.

Choosing the Right Software Partner

When selecting an investment fund management system, consider the following criteria:

- Customizability: Your business needs are unique—ensure the platform can be tailored to your workflow.

- Security: Look for enterprise-grade encryption and compliance with standards like ISO/IEC 27001.

- Customer Support: Dedicated onboarding and responsive support teams are essential for smooth implementation.

- Mobile Access: Cloud-based platforms with mobile apps offer real-time access from anywhere in the world.

Conducting demos and trials can help evaluate how intuitive the software is and whether it integrates with your existing tools.

The Future of Fund Management Technology

The investment management landscape is becoming increasingly digital. Technologies like artificial intelligence (AI), blockchain, and predictive analytics are beginning to influence fund operations. In the near future, fund management software will likely incorporate more machine learning capabilities to detect anomalies, predict market shifts, and offer investment suggestions based on historical patterns.

Conclusion

The financial world is more data-driven and compliance-heavy than ever before. Investment fund management software empowers firms to stay ahead of the curve by automating complex tasks, maintaining transparency, and ensuring precision. As competition in the asset management space grows, adopting the right technology isn't just beneficial—it’s essential to success and sustainability in the modern financial landscape.